Chenxi —

Overview

PayPal Pay in 4 lets you split up payments on your purchases at eligible online retailers into four equal payments. You’ll make the first payment upfront and pay the remaining ones every two weeks for a total repayment period of six weeks.

For example, let’s say you were buying an item for $400. You’d pay $100 at checkout, and then three additional payments of $100 in two-week intervals. PayPal Pay in 4 does not charge any interest, origination fees, late fees, or other fees.

Note that PayPal Pay in 4 is only available on certain goods at select merchants where PayPal is accepted. You must hold a PayPal account and link up an accepted payment method, such as a bank account, credit card, or debit card.

You can select PayPal Pay in 4 at checkout and receive an instant decision about your approval. PayPal will run a soft credit check at the time, but this won’t impact your credit score. If you’re approved, you’ll need to sign a loan agreement that outlines the details of this point-of-sale service.

Launch: December 2022

Platforms: Mobile App

Tools: Figma, Miro

Team: Product Managers, Product Designers, Content Designers, Researchers, Legal Compliance, Soft Engineers, Localization Team, PayPal UI Team, Marketing Team.

My Role: Lead Designer

Sonal Kande - Design Director

Quinn Hanchette - Content Designer

John Empfield, Tanuja Vallabhaneni - Product Manager

Eric Leon, Yao Li - Lead Software Engineer

—————————————————————————————————————

Context

Kickoff

Problems

-

Regarding optimization design, we added new cases and flows that did not exist in live products.

-

In the middle of 2022, the PayPal UI team launched the new App UI library and design system, but our PayPal Pay Later products were outdated.

-

PayPal UI only provides generic UI, but our product had many customized layouts, components, and modules (i.e., donuts and statistics on the tiles), which didn't exist the PayPal UI guideline and design system.

-

In terms of consistency, we had different styling for the App, web, and mWeb (i.e., colors, fonts).

Goals

-

Our main goal is to help customers understand where to start, what to do, and how to keep up with payments. Based on our existing products, we want to provide customers with a flexible, no-fee payment solution to improve their financial stability when making purchases.

-

We have Global Pay Later products in different regions, such as the US, UK, France, Australia, Italy, Spain, and Germany, and we have Web and mWeb for those regions as well. Regarding our bandwidth, we only focus on US Pay in 4 servicing App as the primary goal, then based on US App, redesign Pay Later products for other regions, web and mWeb.

-

Add new use cases and flows to existing products.

-

Update our existing Buy Now Pay Later App services to match the latest PayPal UI App design system.

-

Create our UI Assembly Library to customize some components, and modules and simultaneously match the PayPal UI guideline.

-

Optimize and ilterate styling for the App, web, and mWeb to improve consistency.

—————————————————————————————————————

Design Process

1. Collect and analyze all existing E2E of entry points, and touch-points (i.e., marketing pages, emails, product flows), to understand the customer journey.

2. Identify all existing App servicing flows and cases with the researcher, product managers, and design leadership. Meanwhile, iterate them and add new use cases, features, and flows informed by research, metrics, and feedback to develop a scalable framework based on live products.

3. Collaborate with the PayPal UI team to learn more about the new App design system, then build up/update our Pay in 4 US with content designers. At the same time, based on the PPUI, work with other customer designers to create our customized components and modules, then build up our own Assembly file.

4. Work with the content designers, dev team, legal team, localization team, and other cross- functional teams to update the App happy path and most of the edge cases.

5. Launch the brand-new Pay in 4 US Servicing App 3.0 Version.

"PayPal Pay in 4 is PayPal’s buy now, pay later (BNPL) service for online shoppers. If you use this option at checkout, you can split your purchase into four equal payments with no interest or fees. If you qualify, PayPal Pay in 4 can be a useful way to finance your purchases over a period of six weeks."

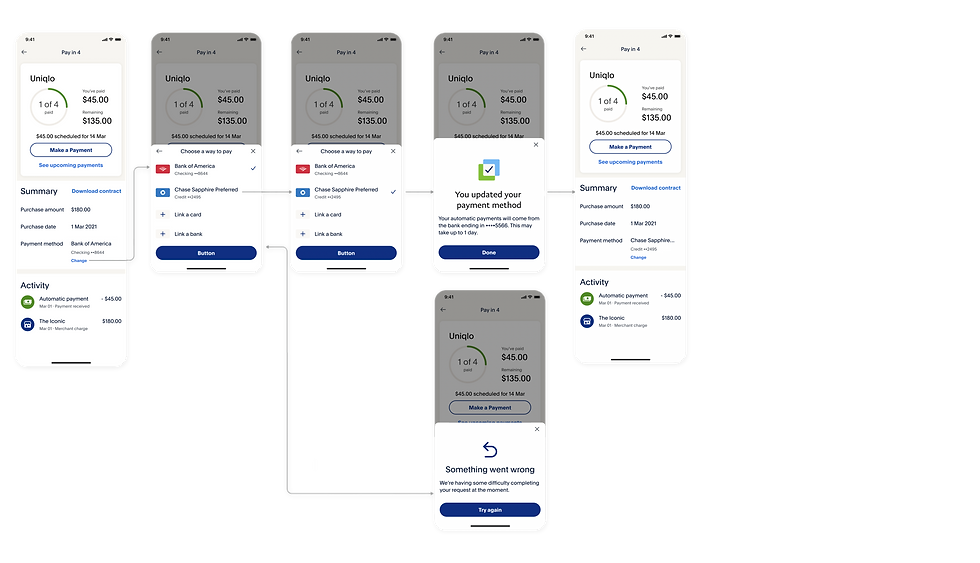

Pay in 4 Servicing US App - Happy path final Version 3.0

Single Plan Upcoming Payment Flow

Multiple Plans Servicing Flow

Change FI

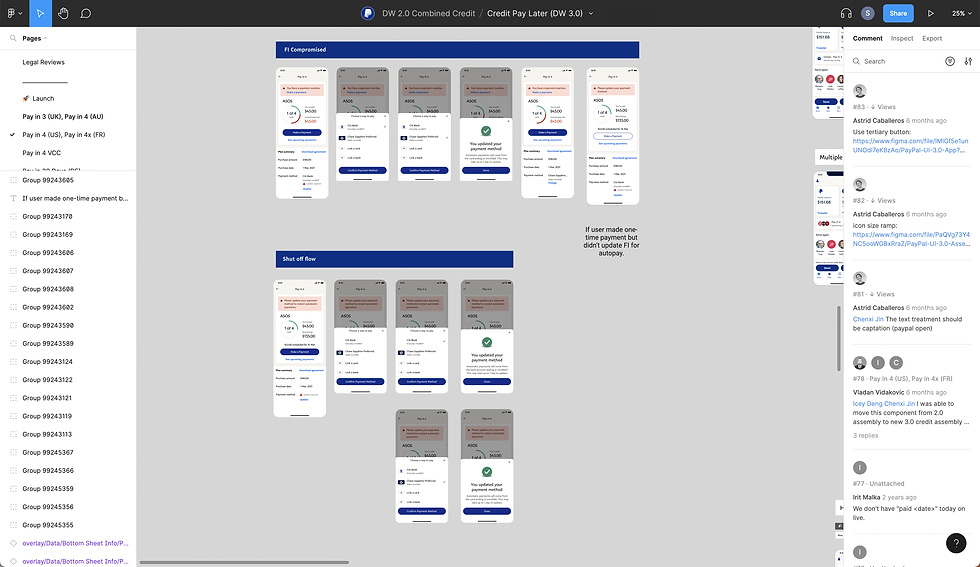

Some Edge Cases Version 3.0

Missed payment FI compromised FI expired No FI display Pending Completed Closed

FI link issue MAP overdue FI issue on MAP Overdue in upcoming Two more payments

——————————————————————————————————————————

Next Steps to Take

-

In terms of consistency, previously we had different styling for the App, web, and mWeb 2.0 (i.e., colors, fonts and components). So based on PayPal Pay in 4 US App Servicing 3.0 design, customized the Web&mWeb UI assembly for our teams and redesign US web and mWeb.

-

Clarify the next goal and scope for the redesign of other regions.